Invidious Nvidia

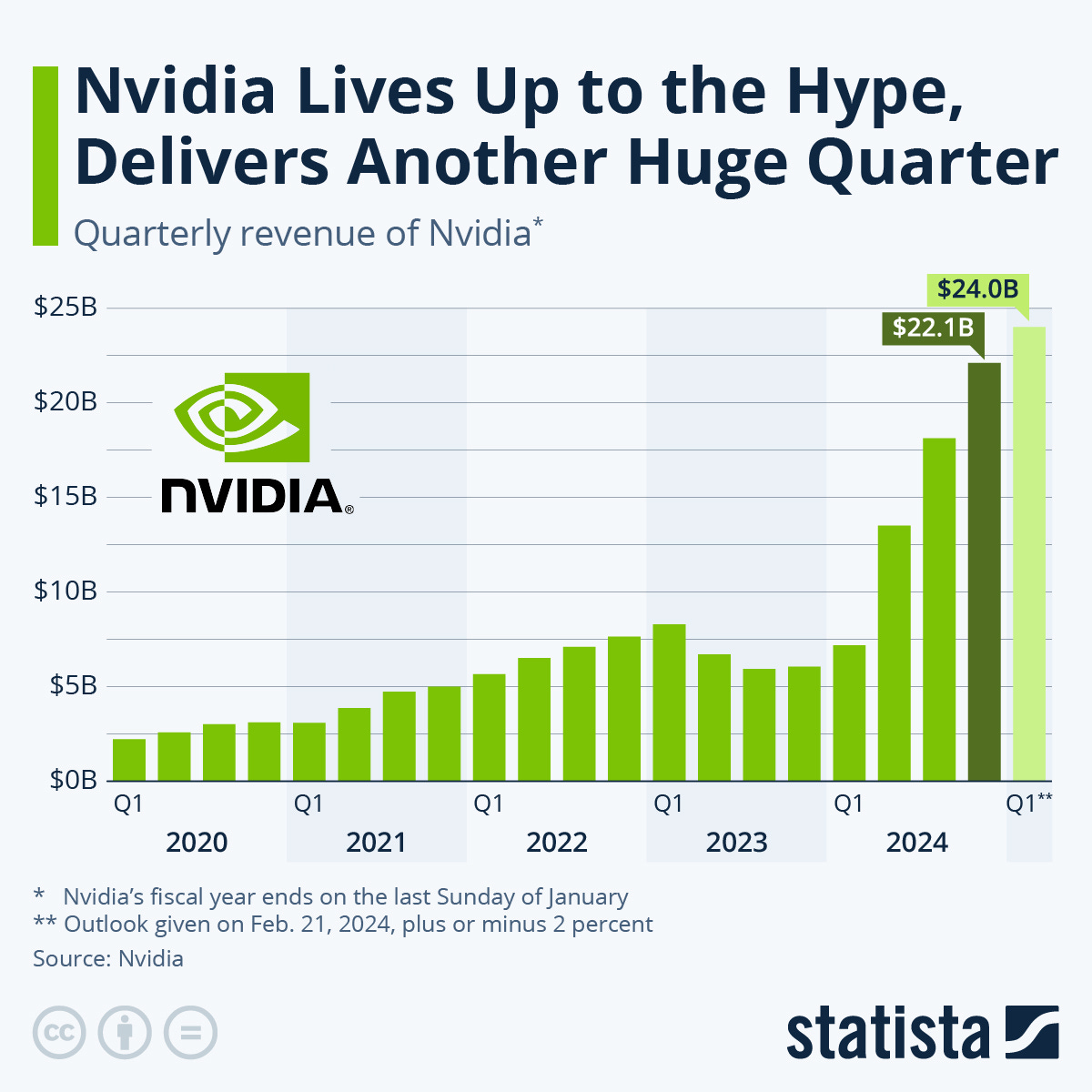

Nvidia’s stock surged again this week, and the company is now worth about $1.9Tn, or as much as Saudi Aramco ( by far the worlds most profitable company and in some ways it’s polar opposite).

Seeing a fast rise, people are super keen to be the first to shout “bubble” and make charts like this ↓ to show that AI is as hyped as the early internet and an equivalent “dot com” bubble is inevitable.

This seems both plausible and unlikely, but the thing is nobody knows.

Seriously, nobody knows anything about how to value stocks in periods of growth, or new tech, or new models, let alone possible new paradigms of business and society.

From Fundamentals to Beliefs

We used to know how value Companies, we did this with “fundamentals”, analysis that was logical, empirical, quantitative and arguable.

We could evaluate companies based loosely on assets, and we had long standing formula to work with and rules of thumb ( but tech companies tend to famously own very little).

We could evaluate companies based on similar benchmarked companies and the past (but this works poorly when the past seems somewhat different).

In theory, a company has a very precise value - the summation of all future cash flows, which one can interpolate into the past and cross reference with others (but these days in some sectors it's rather hard to know what the future brings).

The Dot-Com boom was so exciting that when we did the maths on the fundamentals of tech companies in 1999- 2001 we didn’t get numbers that felt as enthralling as they should be. There was no way to account for the parabolic growth that was possible, nor the economics of network effects, or the idea of zero marginal cost, so we needed a new model, or at least it was helpful to many if we did.

Rather than build a valuation from the company out, we chose to do it from the world in. To do this, back in 2001 we had to ask “What is the value of the internet?” and nobody really knew. We knew it was going to be profound, big, but knowing how much would it be worth was impossible.

It was equally impossible to know how this value would be realized. It’s one thing to save people 2 hours per day, or to enable companies to launch in new markets without an office, it’s another thing for an entity to extract this value as profit.

We didn’t know how this value would be split, we once assumed mobile operators would be the gateways to the web and Vodafone would be the World’s first trillion dollar company (it’s now worth $23 billion). We thought ISP’s would make the cash. It turns out for the moment to be those who monetized attention and sold servers, that made the most.

So in a world of unknowns, optimism, mystique, and the non falsifiable, we turned to stories.

Beliefs and stories.

So since about 2001 the world has been sufficiently tumultuous and money sufficiently free, that stories have been the underpinning of many valuations.

Narratives became the opposite of fundamentals, they were based on emotion, on shared belief, and at times on irrational hope. The dynamics of algorithms can make any niche group of people think they are representative. In the modern era with a near infinite amount of data online, you can find substantiation for any opinion.

It turns out a tranche of modern stocks in ( or most importantly perceived to be in ) Technology, Pharma, Biotech, Green energy or EV’s, can ignore all fundamentals and focus on sentiment. It’s is why shoe makers, fitness equipment makers, luggage brands, skincare companies all hoped for the free pass of “being a tech company”

Now, sometimes it’s been quite sensible to be valued this way, for years Amazon failed to make any money, but people could feel it coming and this has so far been rather true.

Tesla is the same, it’s valuation makes no sense as a car company, but does if we suspend reality a little bit & think of it as software meets energy meets confidence, meets the future en large. We can see the plausible narrative.

In fact many stocks have become more like belief systems than companies.

They have strong charismatic Leaders, myths of origin, a plausible dream, a steady stream of news, perhaps a shared enemy in the form of non believers. These companies are more like religions of the modern era, with tribes, dogmatic followers, ritual, symbols.

Stories explain the absolute madness of the NFT era, the collective insanity of blockchain and Web3. Plausible narratives and greed combine to explain the rise of Crypto, but we’re never sure where suspension of reality meets genuinely brilliant companies in the dawn of a new era of computing .

So that’s where we are with Nvidia, we have no idea.

The thing about valuations on Stories is they (by definition) are not wrong. They are prone to market manipulation and are typically a “greater fool” market, where actually knowing things isn’t helpful ( at least in the short term) , because the price is set by speculators merely hoping to ride an arbitrary wave up or down.

How do you solve evaluate a company like Nvidia.

So is this the start of a bubble, what should Nvidia be worth?

We can start at the bottom and ponder future retuned cashflow, where at a run rate of $48bn profit per year, if the market share and profit margin remain steady for 40 years, it’s value today makes sense.

We can look at it’s growth, and see that if the last 3 years growth is sustained, and it maintains it’s monopolist like margin of 55% (and sales grow beyond the entire size of the global chip market today) the payback period could be as fast at 10 years.

But surely we can assume AMD will challenge more , that Intel will wake up, and a host of other companies ( or Japan ) will secure billions to take on Nvidia in 5-10 years time, to drive down margin.

But we really should have started from the world and down.

What is the value of AI as a whole and how much can be extracted and by whom?

To this we have no idea, but I’ll be exploring (next week) where the value may come from, how it may be realized, when this may happen, how it may happen and the distractions that lay in our way.

I think it goes without saying but the above is not financial advice in any shape or form . The information provided here is for educational and entertainment purposes only and should not be considered professional financial advice.

Bot Fails #301204

I’ve always felt the true test of AI wouldn’t be the Turing test, but that to be “superintelligient” an AI must be able to decipher checked baggage costs and allowances for airline customers.

I think we are far from that , last week we heard about a ChatBot making up the Air Canada bereavement rate policy. Some people look to this and decide bots are a terrible idea, but I happen to think it’s a good example of bots solving the wrong problem. Maybe a really well considered FAQ page would have been enough.

There's an old principle in computing that a computer should never ask a question if it’s able to deduce the answer, and in a world of near infinite computing power I’m amazed how little is changed. We’re all subject to long emails from companies saying “ if you booked this by then” and “if you came via this site” and “if you’ve been a customer for X months” , the end state of AI shouldn’t be personalized ads for Coca Cola, but to send customer service emails that are true, helpful & specific to your circumstance. It shouldn’t involve wading through 40 pages of Health insurance rendered out for you, to still have no idea if you’re covered for your condition, but neither should it be a chatbot.

Quotes of the week.

“After meeting our basic needs as creatures, we enter into the human universe of desire. And knowing what to want is much harder than knowing what to need.”

Luke Burgis

“Brilliant thinking is rare, but courage is in even shorter supply than genius.”

Peter Thiel

“99% of execution is the art of following up without being too annoying”

Strip Mall Guy

"90% of strategy is agreeing shared language for things"

Rob Estreitinho

Little ones

A must read on the rise of Dopamine culture

“Sometimes the AI is better than you, and sometimes you are better than the AI. Good luck guessing which is which” comes from this piece someone sent to me and it’s amazing, sorry I forgot who.

Finally someone else is excited about LED’s and what they could mean for the future, and the parameters of design that they challenge and change.

What if we rethought cities around modern needs, like eCommerce. NYC seems to be crumbling under the pressure, time to use the rivers.

I liked this piece on companies needing a Marie Kondo but for processes. I’ve long felt most technology allows companies to be less reductive and to turbocharge bureaucracy not reduce it. I.E Work expands to fit the technology available. AI is only going to make it far worse, we can now produce (and consume) pointless documents with near infinite efficiency.

A good long read on how this person uses AI, I sense a bit of Gell-Man Amnesia is going on, as is often the case. I also get the feeling a lot of benefit of the doubt is being applied, many times what we find in AI is what we want to, it’s rather like a horoscope, we can decide it’s magical accurate or vague guess, but all food for thought.

Apple could be making a smart ring, this would be quite exciting. I liked my Oura but was absolutely sure it was making up all of the sleep data.

A London Underground station used lots of cameras and AI to do rather amazing and somewhat useful things ( 77 of them) , but this writer thought it was a bit Orwellian, but it’s also possible to be hopeful about what it all means.

Canadian Tire, perhaps the most innovative company you’ve never heard of.

I found a list of brands you can’t sell on Amazon and it’s crazy long

Signup to join my free webinar on 13th March, where I will also talk about my new Digital Transformation course and some new stuff on“transformational thinking”. If you want me to address any particular topics or questions, please reply to this email with what you want it to cover.

Don't be take in by that puff piece on Canadian Tire. Their sales dropped by $1 billion last quarter.

Great read. Thanks Tom